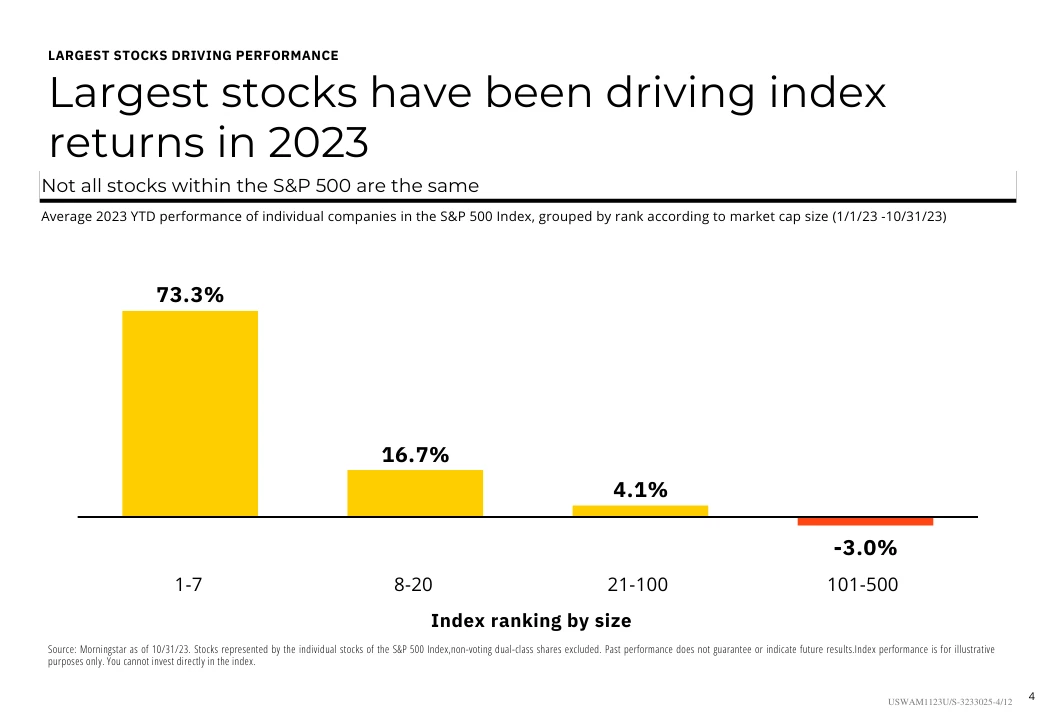

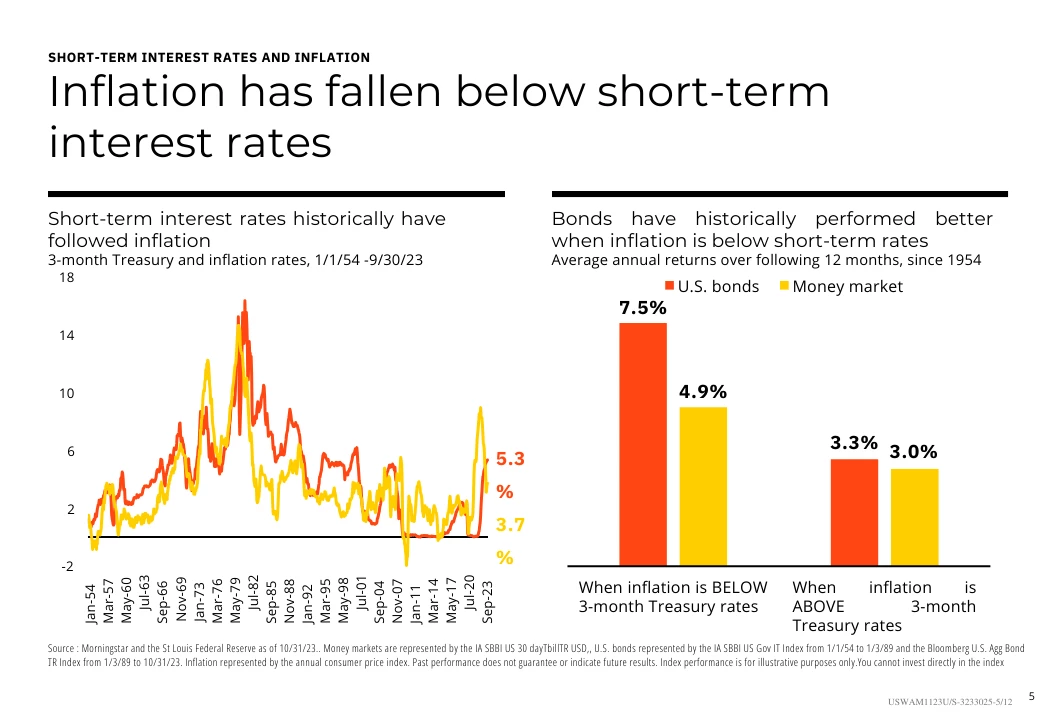

Happy start to the week of Thanksgiving! Last week witnessed a market upswing, with the majority of gains occurring on CPI day (Tuesday). The report indicated inflation below expectations, causing a decline in bond yields and providing a boost to stocks. Small company stocks, in particular, demonstrated strength with an impressive gain of over 5%. Additionally, the market discounted the likelihood of future rate hikes while increasing its anticipation of rate cuts in the coming spring.

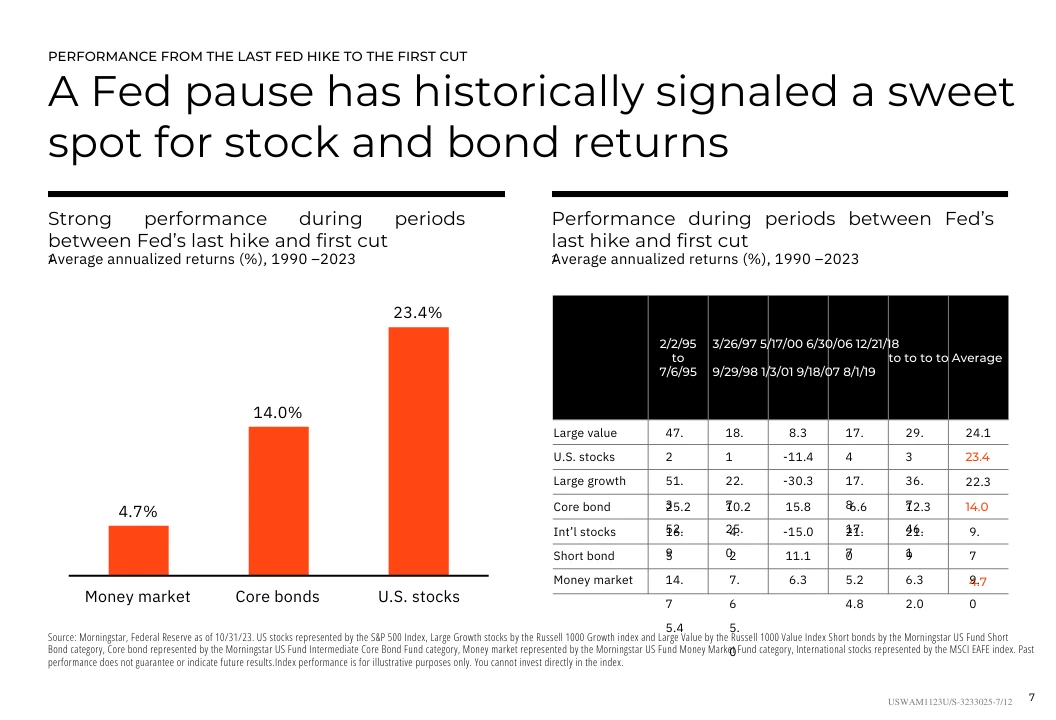

Looking ahead, this week is expected to be relatively subdued due to the holiday, with trading closed on Thursday and a half-day on Friday. I have attached a slide deck from our partners at BlackRock. While there are many good and easily digestible charts, slide 7 is important given our current situation. Historically, when the Fed pauses rate hikes, forward returns have been strong in both the stock and bond markets.